All Categories

Featured

Table of Contents

These investments could have higher prices of return, far better diversity, and several various other characteristics that assist build wide range, and most notably, construct wide range in a shorter amount of time. One of the simplest instances of the advantage of being a certified investor is being able to buy hedge funds. Hedge funds are largely just easily accessible to accredited capitalists because they call for high minimum investment amounts and can have greater associated threats yet their returns can be remarkable.

There are also disadvantages to being an accredited investor that associate to the investments themselves. A lot of financial investments that need a specific to be a recognized financier come with high risk (accredited investor investment networks). The techniques utilized by many funds included a greater threat in order to achieve the goal of defeating the market

Just transferring a few hundred or a few thousand dollars right into an investment will certainly refrain. Accredited investors will certainly need to commit to a few hundred thousand or a few million bucks to partake in investments indicated for accredited financiers. If your financial investment goes south, this is a whole lot of cash to shed.

High-Value Accredited Investor Alternative Investment Deals

These mostly come in the kind of efficiency charges along with administration costs. Performance fees can range in between 15% to 20%. Another con to being a certified investor is the capability to access your investment capital. If you acquire a couple of stocks online with a digital platform, you can pull that cash out any kind of time you such as.

Being an approved financier comes with a great deal of illiquidity. They can also ask to assess your: Financial institution and various other account statementsCredit reportW-2 or various other earnings statementsTax returnsCredentials provided by the Financial Sector Regulatory Authority (FINRA), if any type of These can help a company identify both your economic qualifications and your class as an investor, both of which can influence your standing as an approved capitalist.

A financial investment car, such as a fund, would certainly have to figure out that you certify as an approved capitalist. The advantages of being a certified investor consist of accessibility to distinct financial investment possibilities not readily available to non-accredited financiers, high returns, and raised diversity in your portfolio.

Best-In-Class Accredited Investor Platforms with High-Yield Investments

In specific areas, non-accredited capitalists also deserve to rescission. What this suggests is that if a financier determines they want to take out their money early, they can assert they were a non-accredited financier the entire time and obtain their cash back. Nevertheless, it's never a good idea to give falsified papers, such as fake tax returns or economic statements to a financial investment automobile just to invest, and this might bring lawful difficulty for you down the line - accredited investor opportunities.

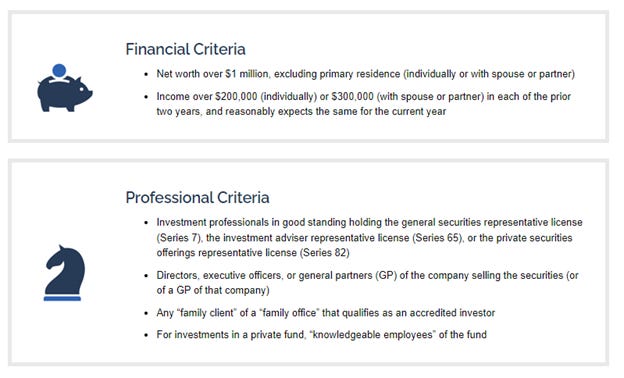

That being claimed, each deal or each fund might have its very own constraints and caps on investment quantities that they will approve from an investor. Certified investors are those that meet specific requirements concerning earnings, credentials, or web worth.

Accredited Investor Investment Networks

Over the past several years, the accredited capitalist meaning has actually been slammed on the basis that its sole emphasis on an asset/income examination has actually unfairly excluded just about the wealthiest individuals from rewarding investment opportunities. In action, the SEC began considering means to increase this definition. After a comprehensive remark duration, the SEC adopted these changes as a means both to catch people that have reliable, alternate indicators of economic refinement and to improve specific outdated sections of the definition.

The SEC's primary issue in its law of unregistered securities offerings is the security of those capitalists that do not have an enough degree of economic class. This issue does not use to well-informed employees since, by the nature of their position, they have adequate experience and accessibility to monetary info to make enlightened financial investment choices.

The identifying aspect is whether a non-executive staff member really joins the private financial investment business's financial investments, which have to be determined on a case-by-case basis. The addition of knowledgeable staff members to the accredited investor interpretation will certainly additionally enable more staff members to spend in their company without the personal investment business risking its very own status as a certified investor.

Top Accredited Investor Secured Investment Opportunities

Prior to the changes, some personal investment firm took the chance of losing their accredited capitalist status if they enabled their staff members to spend in the business's offerings. Under the changed definition, a majority of exclusive investment firm workers will certainly now be eligible to spend. This not only creates an extra source of resources for the personal investment business, but also more lines up the rate of interests of the employee with their employer.

Presently, just individuals holding specific broker or monetary consultant licenses ("Series 7, Series 65, and Collection 82") qualify under the interpretation, yet the changes grant the SEC the ability to consist of extra qualifications, classifications, or qualifications in the future. Specific kinds of entities have likewise been contributed to the definition.

The addition of LLCs is likely one of the most notable enhancement. When the definition was last upgraded in 1989, LLCs were fairly uncommon and were not consisted of as a qualified entity. Because that time, LLCs have become extremely common, and the meaning has been improved to show this. Under the amendments, an LLC is considered a certified capitalist when (i) it has at the very least $5,000,000 in assets and (ii) it has not been developed only for the specific purpose of obtaining the securities offered.

In a similar way, particular family members workplaces and their customers have actually been contributed to the meaning. A "family office" is an entity that is established by a family to manage its assets and attend to its future. To ensure that these entities are covered by the meaning, the amendments mention that a household office will certainly now certify as a recognized capitalist when it (i) takes care of a minimum of $5,000,000 in properties, (ii) has actually not been formed specifically for the purpose of getting the supplied protections, and (iii) is directed by a person who has the monetary sophistication to examine the benefits and risks of the offering.

Top-Rated Top Investment Platforms For Accredited Investors for Accredited Investor Platforms

The SEC requested remarks regarding whether the financial limits for the earnings and possession examinations in the definition should be readjusted. These thresholds have remained in location since 1982 and have actually not been changed to make up rising cost of living or other aspects that have changed in the intervening 38 years. The SEC inevitably determined to leave the asset and earnings limits unmodified for now.

Please let us know if we can be helpful. To review the initial alert, please click right here.

Table of Contents

Latest Posts

How To Start Tax Lien Investing

How Tax Lien Investing Works

Scavenger Tax Sale

More

Latest Posts

How To Start Tax Lien Investing

How Tax Lien Investing Works

Scavenger Tax Sale