All Categories

Featured

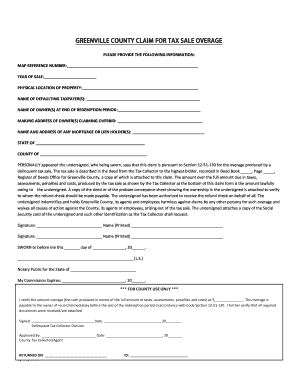

If the property owner does not pay their real estate tax, there can be a Tax Foreclosure by the local region and if that property goes to Tax Repossession auction, there is commonly a prospective buyer that gets the home for greater than what was owed in home tax obligations. Allow me discuss # 2 for you a little much deeper state you owe $15,000 in home tax obligations on your house and your home goes right into Tax obligation Foreclosure.

Claim the home costs $100,000 and from that, the area takes their $15,000 they were owed for real estate tax. Tax Sale Overages. What occurs to the staying $85,000 that the staff of court has in their bank account? The homeowner has to make a case to the county clerk and the court typically evaluates these insurance claims and honors the home owner his money

The county federal government HAS NO OBLIGATION to inform or inform the former house owner. J.P. Morgan claims these Tax obligation Foreclosure sales create virtually 13.6 million dollars in excess, or equity, every single day.

All-In-One Property Tax Overages System Tax Overages

My friend, Bob Ruby, is a specialist in this niche of excess and aids home owners get the cash that is because of them. He just lately told me that they currently have 2.2 million dollars in excess under contract in his workplace and they will receive fees of about 30% of that 2.2 million.

There are a few points you will require to be effective in the excess business. Right here are the four straightforward steps you will certainly need to adhere to: Figure out who is owed the cash and that to get a targeted list. Unclaimed Tax Overages. Since Bob is an attorney, he understands exactly just how to get the checklist required to find these former property owners

The excess market is a fantastic place for a genuine estate newbie to start their occupation. Beginning with tax obligation sale overages, and then work your means up to much more complicated funds like home mortgage repossession excess and unclaimed estates.

This is likewise a fantastic method for someone that doesn't wish to deal residences anymore to remain in the realty market without obtaining their hands also filthy. Bob refers to this as the "Robin Hood System" and if you think of, this name absolutely makes good sense. There is a considerable quantity of cash in it for YOU as an insider who would certainly be finding this money for individuals from the federal government.

Latest Posts

How To Start Tax Lien Investing

How Tax Lien Investing Works

Scavenger Tax Sale